In 2021, Uganda Revenue Authority (URA) rolled out the Electronic Fiscal Receipting and Invoicing Solution (EFRIS) to enhance business efficiencies, reduce the burdens of compliance, and ushering in a new era of meticulous record-keeping among taxpayers. The underlying principle was simple: to mitigate the shortfalls in tax administration while promoting operational efficiency.

This digital innovation is more than just a technological upgrade but a catalyst for change with URA foreseeing EFRIS as a guardian against the prevalence of false refund claims, the shadowy realm of fictitious purchases with no physical trace, and the unverifiable claims arising from the loss of essential financial records.

In this blog, we will explore EFRIS, its components, and the compelling reasons behind its introduction by the Ugandan Revenue Authority (URA). We’ll also delve into the straightforward registration process for EFRIS and discuss various options available for taxpayers to issue receipts and invoices, ensuring that businesses of all sizes can benefit from this transformative system.

What is EFRIS?

EFRIS in full is Electronic Fiscal Receipting and Invoicing Solution. EFRIS entails the use of Electronic Fiscal Devices (EFDs), e-Invoicing or direct communication with business transaction systems to manage the issuance of e-receipts and e-invoices in accordance with the Tax Procedures Code Act 2014. Once a transaction is initiated using any of the solution’s components, transaction details are transmitted to URA in real time to generate e-receipts and e-invoices.

What are the components of EFRIS?

The following are the components of EFRIS;

- a) e-Invoicing

- b) Electronic Fiscal Devices (EFDs).

- c) Electronic Dispenser Controllers (EDCs) to manage compliance of gas stations

Why has URA introduced e-receipting/invoicing?

URA has introduced e-receipting and invoicing to address the following challenges:

- Suppression of sales.

- Non issuance of tax receipts/invoices.

- False refund and offset claims.

- Fictitious Purchases with no physical movement of goods.

- Matching of input tax and output tax hence paying minimal tax liability. (Gross profit liability is maintained between 0.1% to 1%)

- Unverifiable claims by taxpayers due to loss of records.

- Limited access to taxpayers’ records – some taxpayers selectively provide records for tax administration purposes.

- Non- remittance of VAT collected.

- Invoice Trading-Unscrupulous Individuals (employees of companies, accountants and tax agents) selling previously issued invoices to final customers to third parties to claim false input tax credit hence abusing the VAT mechanism.

- Using multiple sets of business records.

- A large informal sector (51% of GDP).

The above challenges will be addressed as the system will provide evidence of daily sales transactions in a technically easy and undisputed way.

How does one register for EFRIS

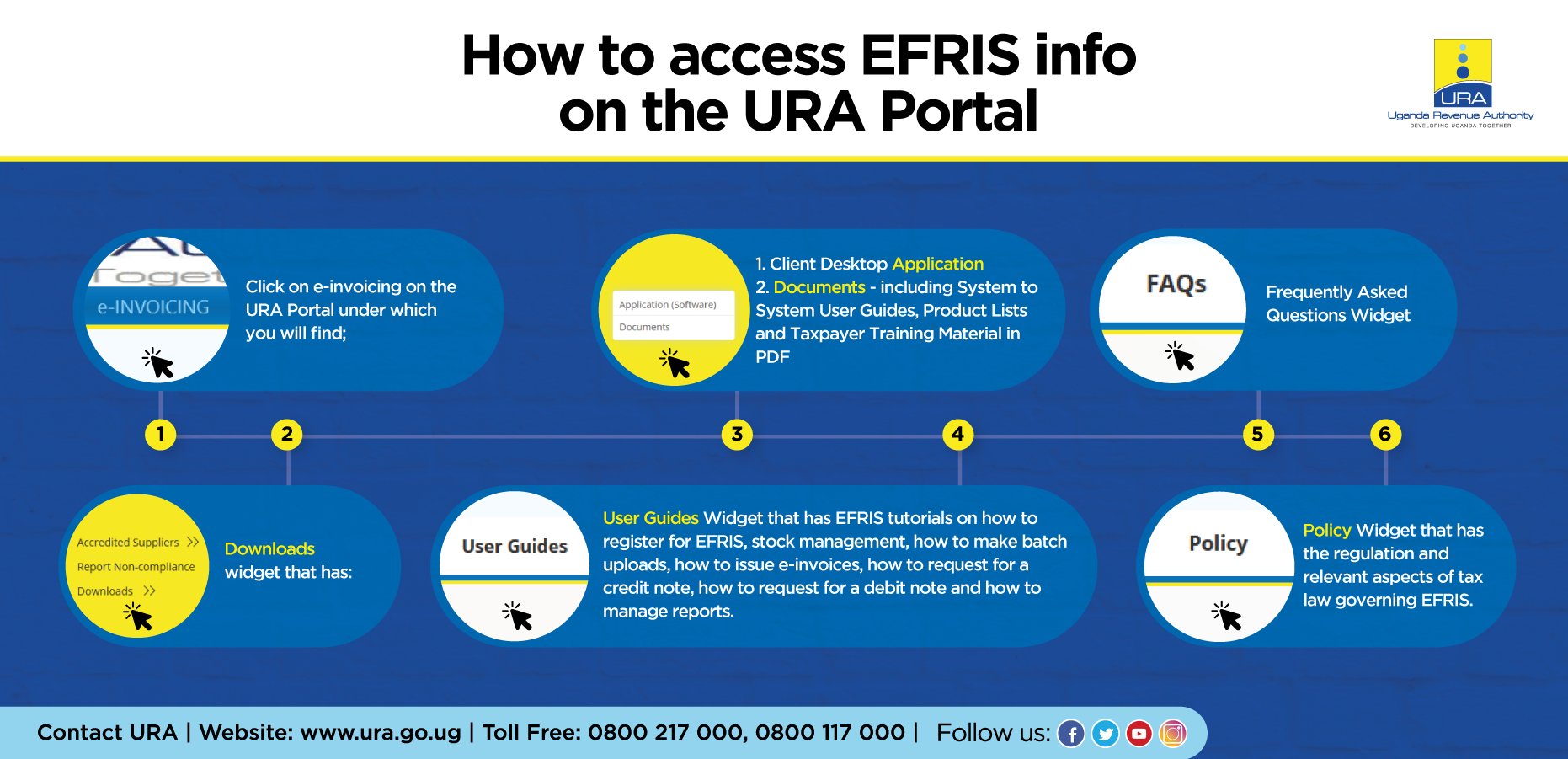

Step 1: The taxpayer accesses the EFRIS link on the web portal and then logs in using their portal credentials. A one-time password (OTP) is then sent to their email or phone number as selected which the taxpayer inputs and gets access to the EFRIS homepage.

Step 2: The taxpayer then selects “First time registration” followed by specification of whether to use e-invoicing and or EFDs, additional places of business (if any) after which the application is submitted to URA for approval.

Step 3: Once the taxpayer’s application is approved by URA, they are then able to use e-invoicing and or EFDs.

NB: In addition to completing the system-to-system connection, accessing the URA web portal or installing the Desktop client app on your device such as computer or smart phone, you must have power, a TIN, and Password to authenticate yourself, and be connected to the internet. For system-to-system connection clients set up an API connection with URA to secure the connection.

What is e-Invoice?

It’s a new application that allows you to safely, easily and free of charge issue electronic tax documents, and check their validity, by logging onto the system, URA web portal, client app and use the e-receipt/invoice number or scanning the Quick Response (QR) Code using the URA validation app or a QR reader (such as Neo Reader app) installed on the smartphone to verify the receipt or invoice information.

What options are available for taxpayers to issue receipts and invoices?

The Solution has the following options available to users to generate e-receipts and e-invoices;

- a) System to system connections for clients with existing sales systems.

- b) The URA web portal.

- c) The Client app.

- d) Electronic Fiscal Devices (EFDs) and

- e) USSD-Quick codes

Once receipt or invoice number is valid or the code is scanned, it will open the verification details and a copy of the e-receipt or e-invoice will be displayed.

What determines the option to be used by a taxpayer?

The options to be used is determined by the taxpayer’s existing method of invoicing and receipting. However, taxpayers can opt for the different methods as summarized below;

| Option | Portal | System to system | Client App | USSD – Quick Codes | EFD |

| Large Taxpayers | ✓ | ✓ | ✓ | ||

| Medium Taxpayers | ✓ | ✓ | ✓ | ✓ | |

| Small Taxpayers | ✓ | ✓ | ✓ | ✓ | ✓ |

| Micro Taxpayers | ✓ | ✓ | ✓ | ✓ |

I have a small business and cannot afford to purchase an EFD or ERP system.

Taxpayers who cannot afford to purchase an EFD or ERP system will use web portal, USSD and client application options.

What is system to system connection?

A system to system connection is the integration of a taxpayer’s invoicing system, Enterprise Resource Planning(ERP) with EFRIS to generate e-receipts and invoices.

How will the system to system connection actually work?

When a sale is made, transactional details will be captured in the seller’s system invoicing system(ERP), encrypted and transmitted to URA in real time to generate e-receipts and e-invoices.

Upon receipt of the transactional details, EFRIS will decrypt the data, format the data into an e-receipt or e-invoice, attach a receipt or invoice number, a verification code, a quick response (QR) code, encrypt the fiscal data and transmits it back to the seller’s system.

At this point, the e-receipt or e-invoice can be printed. The entire process is very quick and should not affect printing of the e-receipt and invoice for customers. Clients (seller and Buyer) can log onto the system, URA web portal, client app and use the e-receipt/invoice number or scan the Quick Response (QR) Code using the URA validation app or a QR reader (such as Neo Reader app) installed on the smartphone to verify the receipt or invoice information